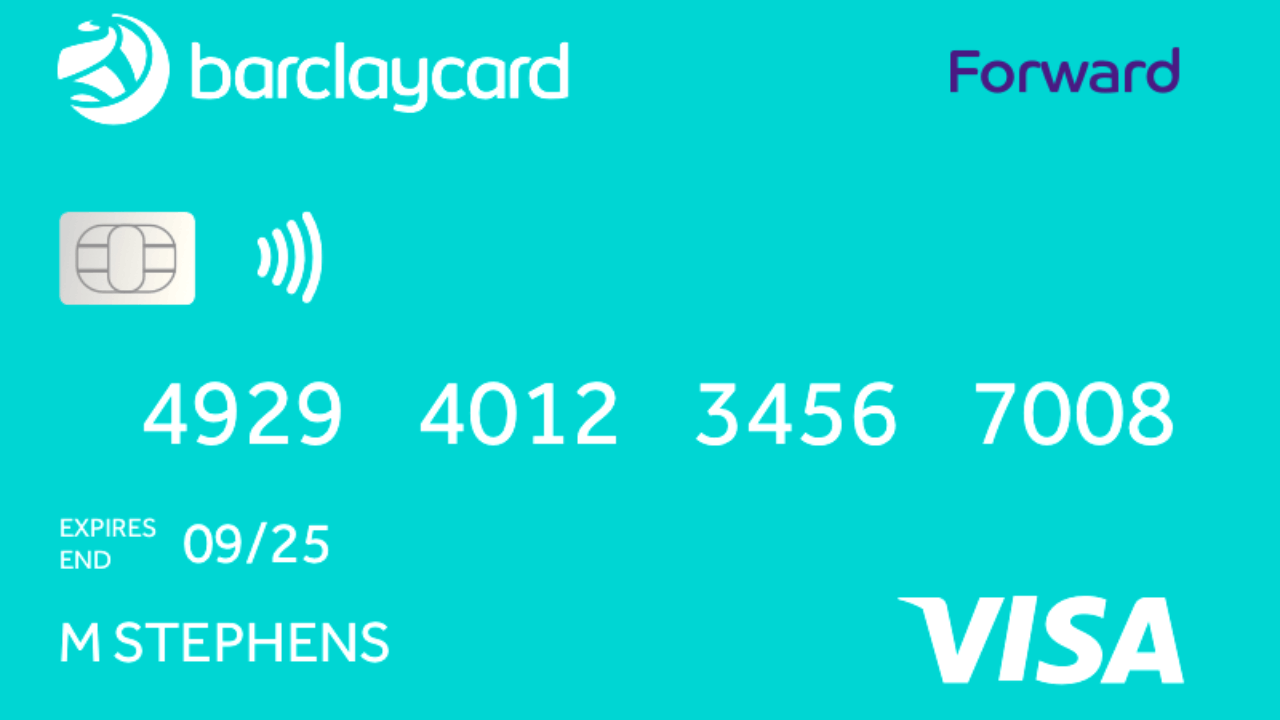

Credit builder cards are meant for people who are new to credit or those who have been suffering from poor credit. If you’re looking for a good credit builder card to help jumpstart your credit rating, the Barclaycard Forward Card offers some of the best offers and benefits that you can find.

The card features no annual fee and when you sign up, your credit limit is tailored to your needs. Forward Card owners are also assisted by notifications and alerts so you’ll always be able to stay within your credit limits and pay on time. These are just some of the amazing features and benefits you get to enjoy when you have the Barclaycard Forward Card.

If you want to order a Forward Card, check out the guide down below.

- Learn More about the Barclaycard Forward Card

- What to Do If You’re New to Credit

- Check Out These Benefits When You Get the Barclaycard Forward Card

- Only One Simple Fee Abroad

- Here’s How You Can Check for Your Eligibility

Learn More about the Barclaycard Forward Card

Those who are looking to start building their credit score will be happy to know that Barclaycard is offering their latest and best credit card – the Barclaycard Forward Card. With the Barclaycard Forward Card, you get to enjoy different perks and benefits.

The card offers a variable Annual Percentage Rate of 33.9% which means that you don’t get a fixed rate and can easily change in favorable situations. You also get a personalized credit limit of up to £1,200. Apart from that, you also get a variable Purchase Rate of 33.9%.

If you’re willing to pay your credit in full each month, you won’t be paying any interest on purchases. Make sure that you keep on making all of your payments on time to enjoy a 3% interest rate reduction and another 2% reduction in the second year.

Additionally, you’ll get zero interest rate on purchases for the first 3 months from the date you opened your account.

Find Out How You Can Reach Out to Them

If you wish to learn more about the Barclaycard Forward Card, you can always talk to their Customer Services at 0800 151 0900. They are available on Monday to Friday from 8 AM to 8 PM and on Saturdays from 9 AM to 5 PM.

If you are calling from abroad, you can use the number – +44 (0)1604 230 230. You can also reach out to them through their mobile app which is both available at the Google Play Store and the Apple App Store.

You can also visit their registered office at 1 Churchill Place, London E14 5HP.

What to Do If You’re New to Credit

Barclaycard offers one of the most user-friendly cards with the Forward Card. It is important that you know how credit cards work especially if you are still new.

First, you need to understand it is important that you stay within your credit limit. The Forward Card has a personalized credit limit based on what you can afford. Whenever you’re near your credit limit, you will receive a notification that will prompt you to stay within your credit limit.

This will impact your credit rating which is a factor that will likely determine your future with your card. Next, you also need to pay on time.

There are three different types of payments that you can do but it is highly advised that you try to pay the full amount on time so you won’t have to pay for the interest.

Get Notified with Text and Email Alerts

For those who are struggling with their credit, Barclaycard has set up built-in alerts to help you get notifications in case you are about to go beyond your credit limit. You’ll also receive text and email alerts that will notify you of your due date.

Having these notifications will help you prepare your budget and be able to pay your bills on time. There are also other alerts that you can choose to receive such as weekly balance updates, notifications when your statement is available, and balance limit alerts.

You can also check your account by setting up your online Barclaycard account. This is an incredibly convenient way to manage your account better.

Check Out These Benefits When You Get the Barclaycard Forward Card

Having a Barclaycard Forward Card is not just about getting a credit card, it is a lifestyle. You’ll forever change the way you live your life with this credit card.

First, you’ll have up to five months of free subscription to Apple TV+, Apple Music, Apple Fitness+, Apple Arcade, and Apple News+.

Take note that after the free subscription, it will automatically charge your credit card so be sure to cancel your subscription if you do not wish to continue.

Speaking of entertainment, you’ll also receive perks such as having access to selected live events like concerts of your favorite artists, festivals, and more. You can do more with your Forward Card now than ever before so go ahead and enjoy these perks.

Receive Cashback Rewards and Even Share Your Card with Someone Close

Apart from keeping you entertained with all the perks, you’ll also receive cashback rewards every time you use the card. Make sure to check out all the participating retailers and use the card for the purchase.

You’ll need to register for this benefit first before you can take advantage of it but the moment you do, you’ll receive up to 15% cashback. You also have the option to share your card with a loved one or a partner so you’ll have more chances of earning the cashback rewards.

Make sure that you assign a cardholder before using the card to avoid any issues. The best part about this is that you can sign one totally free.

Only One Simple Fee Abroad

If you’re fond of traveling abroad or you just need to use the card while on vacation, the Barclaycard Forward Card is the best credit card to use.

You can use the Forward Card to make payments overseas. Use it on partner restaurants and other establishments.

You also gain access to emergency cash using this credit card which is quite helpful if you suddenly run out of cash to use.

With just one simple fee, you’ll have all of this when you’re abroad.

Experience 24/7 Fraud Protection

Many credit card holders are always wary of online scams and security threats. This is why Barclaycard has strengthened its security service by imposing 24/7 fraud protection on every card that you own.

Even when you’re just using the card to pay for groceries or purchase a souvenir abroad, your card will always be monitored nonstop to prevent any fraudulent activity.

This ensures the safety of your card and your personal details. You will receive a notification if your card is used for fraud and you can immediately opt to disable the card pending investigations.

Here’s How You Can Check for Your Eligibility

If you’re interested in all the benefits and perks that you can get with the card, you must learn your eligibility first.

Make sure that you are 18 years old and above and that you haven’t declared bankruptcy in the past six years. You also must not have more than one County Court Judgement for you to be eligible.

Next, you need to have a permanent UK address for at least two years and you should be employed with an income of more than £3,000 every year.

This will increase your chances of getting a Barclaycard Forward Card and proceeding to the application process if you are deemed eligible. You can also head over to their official website to check for your eligibility.

Learn How to Order the Barclaycard Forward Card

Once you’re eligible for the card, you can then proceed to apply for one. Make sure that you prepare certain information before your application. These include the address details, your phone and email address, your employment details alongside your annual income before tax, monthly income after tax, and your monthly expenses.

You should also have your main bank account sort code together with the account number. There are also times when they will ask for additional documents like copies of your last two bank statements or payslips.

When you have all of these prepared, go ahead and fill in the information needed on the form. Make sure that you read the Terms and Conditions properly before sending your information. You will receive a notification once your application has been verified.

Conclusion

The Barclaycard Forward Card is a solid credit card with some of the most attractive features that you can find. Those who want to build their credit or want to start their credit can apply for the card. If you have little to no credit history, this is the right card for you.

Note: There are risks involved when applying for and using credit. Consult the bank’s terms and conditions page for more information.